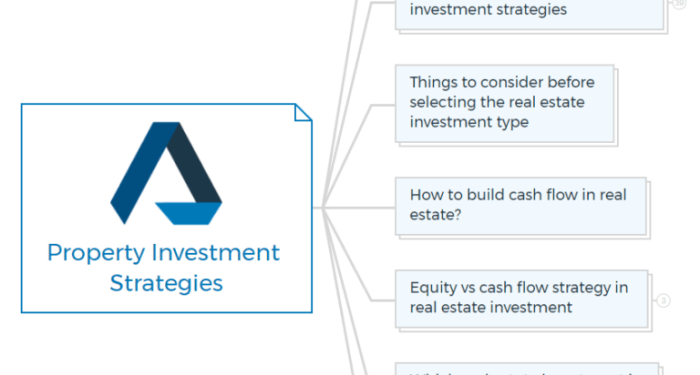

Embark on a journey into the realm of Private Wealth Management Strategies for Property Investors, where financial success meets strategic planning. This comprehensive guide delves into the intricacies of managing wealth in property investments, offering valuable insights and expert advice to navigate the complex landscape of real estate portfolios.

Overview of Private Wealth Management in Property Investment

Private Wealth Management in the context of property investments involves the strategic management of an individual's wealth specifically tailored to their real estate holdings. This specialized approach takes into account the unique characteristics of property investments and aims to maximize returns while minimizing risks.Tailored wealth management strategies are crucial for property investors due to the complex nature of real estate assets.

Unlike traditional investment vehicles, such as stocks or bonds, properties require a different set of considerations, including property maintenance, rental income, market fluctuations, and tax implications. By incorporating private wealth management techniques, investors can better navigate these complexities and optimize their property portfolios.The benefits of incorporating private wealth management techniques in property portfolios are numerous.

Firstly, it allows investors to diversify their wealth across different types of real estate properties, reducing overall risk exposure. Secondly, personalized wealth management strategies can help investors capitalize on market opportunities and enhance the overall performance of their real estate investments.

Lastly, by working with experienced wealth managers, property investors can gain access to specialized expertise and resources to make informed decisions that align with their financial goals.

Financial Planning for Property Investors

When it comes to property investment, having a solid financial plan is crucial for success. Property investors need to consider various factors to ensure their investments are profitable and sustainable in the long run.

Key Financial Planning Considerations for Property Investors

- Setting clear investment goals and objectives

- Creating a detailed budget and cash flow analysis

- Understanding financing options and mortgage rates

- Diversifying investment portfolio to manage risk

- Regularly reviewing and adjusting the financial plan

The Role of Risk Management in Financial Planning for Property Investments

Risk management is essential for property investors to protect their investments from potential financial losses. By identifying and assessing risks associated with property investments, investors can take proactive measures to mitigate risks and safeguard their portfolio.

How Tax Planning Can Optimize Returns for Property Investors

Effective tax planning can help property investors maximize their returns by taking advantage of tax incentives and deductions. By structuring investments strategically and utilizing tax-efficient strategies, investors can reduce their tax liabilities and increase their overall profitability.

Diversification Strategies in Property Investment

When it comes to property investment, diversification is a key strategy that can help investors mitigate risks and maximize returns. By spreading investments across different types of properties and locations, investors can reduce the impact of market fluctuations and potential losses in any one area.

Types of Diversified Investment Strategies

- Diversifying Across Property Types: Investors can diversify their portfolio by investing in a mix of residential, commercial, industrial, and retail properties. This helps spread risk across different sectors and can provide stability during market shifts.

- Diversifying Across Locations: Investing in properties in different cities, states, or countries can help investors minimize the impact of regional economic downturns or local market fluctuations. It also allows for exposure to different real estate markets with varying growth potential.

- Investing in Real Estate Investment Trusts (REITs): Another way to diversify is by investing in REITs, which are companies that own, operate, or finance income-generating real estate. REITs provide exposure to a diversified portfolio of properties without the need for direct ownership.

Advantages of Diversification in Property Investment

- Risk Mitigation: Diversification helps reduce the impact of market volatility and potential losses in any single property or location.

- Stable Income Streams: By diversifying across different property types and locations, investors can create a more stable income stream from rental payments and property appreciation.

- Enhanced Growth Potential: Investing in diverse properties can provide exposure to various real estate markets, allowing for greater growth potential and capital appreciation over time.

Estate Planning for Property Investors

Estate planning is a crucial aspect of financial management for property investors as it ensures the orderly transfer of assets to beneficiaries in the event of the investor's passing. It involves making decisions about who will inherit the property assets, how they will be managed, and minimizing tax implications.

Importance of Estate Planning

- Estate planning helps property investors preserve their wealth for future generations by ensuring that their assets are distributed according to their wishes.

- It also allows investors to minimize tax liabilities, as proper estate planning can help reduce estate taxes and other expenses that could diminish the value of the property assets.

- By creating an estate plan, property investors can avoid conflicts among family members and provide clarity on how their assets should be managed and distributed.

Wealth Preservation and Succession

- Estate planning plays a crucial role in wealth preservation by outlining a clear strategy for passing down property assets to heirs without unnecessary delays or complications.

- It ensures a smooth transfer of property assets to the next generation, allowing the family wealth to be preserved and protected for the long term.

Incorporating Property Assets into an Estate Plan

- Property investors can effectively incorporate their real estate holdings into an estate plan by clearly documenting ownership details, titles, and any specific instructions for the management and distribution of the properties.

- Seeking professional advice from estate planning attorneys and financial advisors can help investors navigate the complexities of including property assets in their estate plan and ensure that their wishes are carried out effectively.

- Regularly reviewing and updating the estate plan is essential to reflect any changes in property ownership, market values, or personal circumstances that may impact the distribution of assets.

Risk Management Techniques for Property Investment

Property investment, like any other form of investment, comes with its own set of risks that investors need to be aware of and prepared for. In order to maximize returns and protect their investments, property investors must employ effective risk management techniques tailored specifically for the real estate market.

Identifying Common Risks in Property Investments

- Market risk: Fluctuations in property values due to economic conditions or market trends.

- Liquidity risk: The inability to quickly sell a property without incurring significant losses.

- Interest rate risk: Changes in interest rates can impact financing costs and property values.

- Operational risk: Unexpected expenses or issues with tenants can affect cash flow.

Risk Mitigation Strategies for Property Investors

- Diversification: Spreading investments across different types of properties or locations can help reduce overall risk.

- Thorough due diligence: Conducting comprehensive research before purchasing a property can uncover potential risks.

- Maintaining adequate reserves: Having cash reserves can help cover unexpected expenses or periods of low occupancy.

- Regular property inspections: Monitoring the condition of the property can help prevent costly repairs or damages.

Role of Insurance in Managing Risks in Property Portfolios

- Property insurance: Protects against damages to the property due to natural disasters, accidents, or vandalism.

- Rental income insurance: Covers loss of rental income due to tenant default or property damage.

- Liability insurance: Provides protection in case of lawsuits or claims against the property owner.

Last Point

In conclusion, Private Wealth Management Strategies for Property Investors serve as a cornerstone for building a robust financial future in the realm of real estate. By implementing tailored strategies, diversifying investments, and effectively managing risks, investors can secure long-term prosperity and growth in their property portfolios.

FAQ Insights

How can Private Wealth Management benefit property investors?

Private Wealth Management offers personalized strategies to optimize investment returns, mitigate risks, and enhance overall financial performance in property portfolios.

Why is diversification important in property investment?

Diversification helps property investors spread risks across different assets and locations, reducing exposure to market fluctuations and enhancing portfolio stability.

What role does tax planning play in property investments?

Tax planning can significantly impact returns for property investors by minimizing tax liabilities, maximizing deductions, and optimizing overall financial efficiency.

How can estate planning benefit property investors?

Estate planning ensures the smooth transfer of wealth, preservation of assets, and succession planning, providing a secure financial future for property investors and their beneficiaries.

What are some common risks associated with property investments?

Common risks include market fluctuations, unexpected expenses, property depreciation, and liquidity challenges, which can be mitigated through strategic risk management techniques.