How Wealth Planning Services Support Real Estate Wealth Preservation sets the stage for this intriguing narrative, offering readers an insight into a story rich in detail and brimming with originality.

The subsequent paragraphs will delve into the various aspects of wealth planning services in real estate, providing a comprehensive understanding of their significance and impact.

Introduction to Wealth Planning Services in Real Estate

In the realm of real estate investing, wealth planning services play a crucial role in ensuring the long-term success and preservation of wealth for investors. These services are designed to help individuals and businesses strategically manage their assets, including real estate holdings, to maximize financial growth and minimize risks.

Importance of Wealth Planning for Real Estate Investors

Wealth planning services are essential for real estate investors as they provide a roadmap for achieving financial goals and securing assets for future generations. By creating a comprehensive wealth plan, investors can effectively manage their real estate portfolio, minimize tax liabilities, and protect their wealth from market volatility.

Role of Wealth Planning Services in Preserving Real Estate Wealth

Wealth planning services play a crucial role in preserving real estate wealth by helping investors make informed decisions about their investments. These services offer personalized strategies to optimize real estate holdings, diversify portfolios, and mitigate risks associated with property ownership.

Through proactive wealth planning, investors can safeguard their assets and ensure a stable financial future.

Strategies for Real Estate Wealth Preservation

Real estate wealth preservation involves implementing various strategies to protect and grow assets over time. By utilizing effective wealth preservation strategies, individuals can ensure the long-term financial security of their real estate investments.

Common Strategies Used in Real Estate Wealth Preservation

- Diversification: Spreading investments across different types of real estate properties can help reduce risk and increase returns.

- Regular Maintenance and Upgrades: Keeping properties well-maintained and up-to-date can increase their value and attract higher rental income.

- Tax Planning: Utilizing tax-efficient strategies can help minimize tax liabilities and maximize profits from real estate investments.

- Estate Planning: Setting up a comprehensive estate plan can ensure a smooth transfer of real estate assets to future generations.

Compare and Contrast Different Approaches to Preserving Wealth in Real Estate

- Long-Term vs. Short-Term Investment: While some investors focus on long-term appreciation and rental income, others may opt for short-term gains through property flipping.

- Active vs. Passive Management: Investors can choose to actively manage their real estate investments or opt for a more hands-off approach through REITs or real estate funds.

- Debt vs. Equity Financing: Deciding between debt financing (mortgages) and equity financing (using own funds) can impact cash flow and overall returns on real estate investments.

Examples of Successful Wealth Preservation Strategies in Real Estate

- Buy and Hold Strategy: Investing in properties with long-term growth potential and holding onto them for appreciation and steady rental income.

- 1031 Exchange: Utilizing a 1031 exchange to defer capital gains taxes by reinvesting proceeds from the sale of one property into another like-kind property.

- Asset Protection Trusts: Setting up asset protection trusts to shield real estate assets from potential creditors and legal claims.

Benefits of Wealth Planning Services for Real Estate Investors

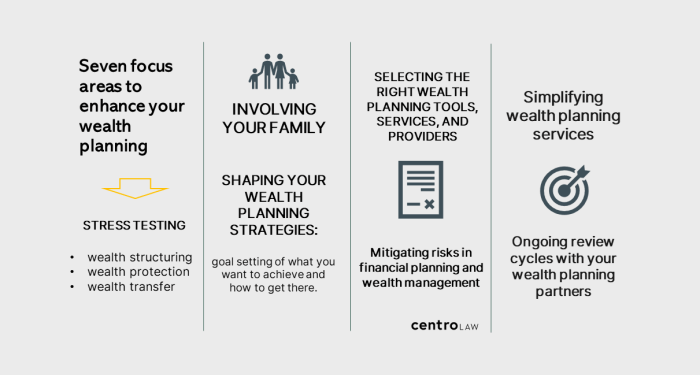

Utilizing wealth planning services for real estate investments comes with a plethora of advantages. These services are designed to help investors mitigate risks, optimize their portfolios, and ultimately preserve their wealth effectively.

Risk Mitigation

Wealth planning services play a crucial role in helping real estate investors mitigate risks associated with their investments. By conducting thorough risk assessments and implementing strategies to diversify portfolios, these services can help protect investors from potential financial losses in the volatile real estate market.

Portfolio Optimization

One of the key benefits of wealth planning services for real estate investors is the ability to optimize their portfolios for maximum returns. These services analyze market trends, identify growth opportunities, and adjust investment strategies accordingly to ensure that investors' portfolios are well-positioned for long-term wealth preservation.

Wealth Preservation

Wealth planning services are essential for real estate investors looking to preserve and grow their wealth over time

Legal and Tax Considerations in Real Estate Wealth Preservation

When it comes to preserving wealth in real estate, legal and tax considerations play a crucial role in ensuring long-term financial stability. Understanding the legal aspects and tax implications of real estate investments is essential for investors to make informed decisions and protect their assets.:Legal regulations and tax laws can significantly impact the overall value of real estate investments.

From property ownership structures to capital gains taxes, various factors must be considered to maximize wealth preservation in real estate. Wealth planning services can provide valuable guidance on navigating these complex legal and tax landscapes to minimize risks and optimize financial outcomes.

Impact of Legal Regulations on Real Estate Wealth Preservation

Legal regulations in real estate can affect property ownership, transfer of assets, and estate planning strategies. It is crucial for investors to comply with zoning laws, building codes, and other regulations to avoid legal disputes and financial penalties. Wealth planning services can help investors understand and adhere to these regulations to safeguard their real estate investments.

Minimizing Tax Liabilities in Real Estate Investments

- Utilizing tax-efficient investment structures such as real estate investment trusts (REITs) or limited liability companies (LLCs) can help reduce tax liabilities on rental income and capital gains.

- Engaging in 1031 exchanges or like-kind exchanges can defer capital gains taxes when reinvesting in similar properties within a specific timeframe.

- Taking advantage of tax deductions for property expenses, depreciation, and mortgage interest can lower taxable income from real estate investments.

Strategies for Tax-Efficient Estate Planning in Real Estate

- Establishing a comprehensive estate plan that includes wills, trusts, and powers of attorney can help minimize estate taxes and facilitate the transfer of real estate assets to beneficiaries.

- Utilizing gifting strategies to transfer ownership of real estate assets to family members can reduce the taxable estate and ensure a smooth transition of wealth.

- Consulting with tax advisors and estate planning experts can help investors create customized strategies to protect their real estate wealth and optimize tax efficiency.

Case Studies and Examples

Real-life case studies serve as powerful examples of how wealth planning services can effectively support real estate wealth preservation. Let's delve into specific scenarios where these services have made a significant impact.

Case Study 1: Family Estate Succession

In this case, a wealthy family with a diverse real estate portfolio sought wealth planning services to ensure a smooth transition of assets to future generations. By implementing strategic estate planning, including trusts and tax-efficient structures, the family was able to minimize estate taxes and maintain the value of their real estate holdings over time.

This case highlights how proper wealth planning can secure the legacy of real estate wealth for generations to come.

Case Study 2: Property Portfolio Diversification

An experienced real estate investor faced the challenge of consolidating and diversifying a large portfolio of properties to mitigate risks and optimize returns. Through wealth planning services, including asset allocation strategies and risk management techniques, the investor successfully restructured their portfolio to achieve a more balanced and resilient real estate investment strategy.

This case demonstrates the importance of proactive wealth planning in adapting to changing market conditions and maximizing long-term wealth preservation.

Case Study 3: Tax Optimization for Commercial Properties

A business owner with multiple commercial properties sought wealth planning advice to minimize tax liabilities and enhance cash flow from their real estate investments. By leveraging tax-efficient structures such as like-kind exchanges and cost segregation, the owner was able to significantly reduce tax burdens and increase profitability across their property portfolio.

This case underscores the critical role of tax planning in preserving and growing real estate wealth effectively.

Final Summary

In conclusion, the discussion on How Wealth Planning Services Support Real Estate Wealth Preservation highlights the crucial role these services play in ensuring the longevity and growth of real estate investments.

Essential FAQs

What are the common strategies used in real estate wealth preservation?

Common strategies include diversification, asset protection, and tax optimization.

How can wealth planning services help investors mitigate risks in real estate?

Wealth planning services can provide risk assessment, asset allocation, and contingency planning to minimize risks.

What legal aspects are related to wealth preservation in real estate?

Legal aspects include property ownership structures, estate planning, and compliance with regulations.