Delving into the realm of global real estate holdings, this article explores the pivotal role that multi family office services play in supporting and enhancing investments worldwide. From wealth planning to risk management, discover how these specialized services cater to the unique needs of individuals and families navigating the complexities of international real estate portfolios.

Overview of Multi Family Office Services in Real Estate

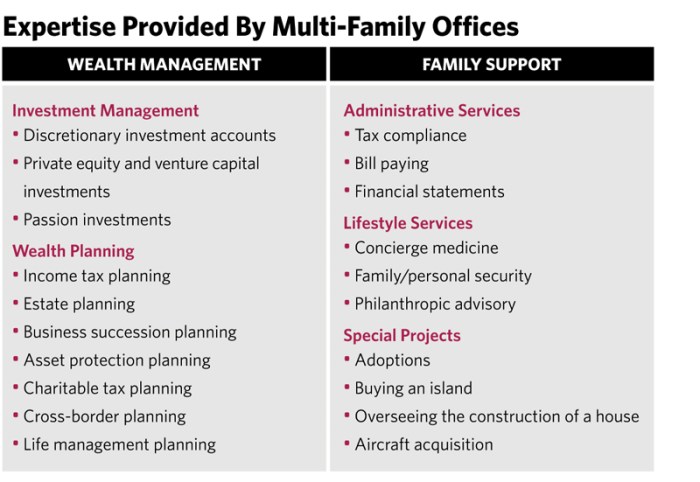

Family offices are private wealth management advisory firms that serve ultra-high-net-worth individuals and families. Multi family offices, in particular, cater to the needs of multiple wealthy families, providing a wide range of services beyond traditional wealth management. When it comes to real estate holdings, multi family offices offer specialized services to help clients manage, grow, and diversify their real estate portfolios.

Differences from Traditional Wealth Management

- Personalized Approach: Multi family offices provide highly customized services tailored to the unique needs and goals of each family, including real estate investments.

- Comprehensive Solutions: These firms offer a holistic approach to wealth management, integrating real estate holdings into the overall financial strategy.

- Specialized Expertise: Multi family offices often have in-house real estate experts who can provide valuable insights and guidance on property investments.

Services Offered in Real Estate Sector

- Real Estate Investment Analysis: Multi family offices conduct thorough analysis of potential real estate investments to assess risks and returns.

- Portfolio Diversification: They help clients diversify their real estate portfolios by identifying opportunities in different sectors and markets.

- Property Management: Some multi family offices offer property management services to oversee the day-to-day operations of real estate assets.

- Strategic Planning: These firms assist clients in developing long-term real estate investment strategies aligned with their financial goals.

Importance of Multi Family Office Services for Global Real Estate Holdings

Individuals or families with global real estate investments benefit significantly from multi family office services due to the complex nature of managing such diversified portfolios. These services offer specialized expertise and resources tailored to the unique needs of global real estate investors, helping them navigate challenges and maximize returns.

Key Challenges Faced by Investors in Managing Global Real Estate Portfolios

- Market Volatility: Global real estate markets can be highly volatile, making it challenging for investors to predict and manage risks effectively.

- Regulatory Compliance: Investors must navigate complex regulatory environments in different countries, requiring expert knowledge and resources to ensure compliance.

- Currency Fluctuations: Fluctuations in exchange rates can impact the value of real estate holdings in different regions, creating additional risk for investors.

How Multi Family Offices Help Mitigate Risks Associated with Global Real Estate Holdings

- Specialized Expertise: Multi family offices offer access to professionals with in-depth knowledge of global real estate markets, helping investors make informed decisions and mitigate risks.

- Diversification Strategies: These services help investors diversify their real estate holdings across different regions and asset classes, reducing exposure to market-specific risks.

- Risk Management Tools: Multi family offices provide sophisticated risk management tools and strategies to protect the value of global real estate portfolios against market fluctuations and other external factors.

Wealth Planning and Structuring for Global Real Estate Investments

When it comes to managing wealth and structuring investments in global real estate, multi family offices play a crucial role in providing specialized services tailored to the unique needs of high-net-worth individuals and families. These offices offer comprehensive wealth planning strategies to optimize returns, minimize risks, and ensure the long-term sustainability of real estate holdings.

Tax-Efficient Structuring Strategies for International Real Estate Assets

Multi family offices utilize various tax-efficient structuring strategies to help their clients maximize their returns and minimize tax liabilities on international real estate investments. Some common strategies include:

- Setting up offshore holding companies in jurisdictions with favorable tax laws to reduce tax exposure

- Utilizing real estate investment trusts (REITs) for tax-efficient income distribution

- Implementing cross-border financing structures to leverage tax benefits

Generational Wealth Transfer Planning for Global Real Estate Investments

Multi family offices also assist high-net-worth families in planning for the transfer of wealth across generations, especially when it comes to global real estate investments. They help in:

- Establishing trust structures to facilitate smooth transfer of real estate assets to heirs

- Implementing estate planning strategies to minimize tax implications on inherited properties

- Providing guidance on succession planning to ensure the preservation of family wealth and assets

Risk Management and Compliance in Global Real Estate

When it comes to managing global real estate investments, risk management and compliance are crucial aspects that multi family offices handle with precision and expertise. These offices play a significant role in ensuring that international real estate holdings comply with regulations and are protected against potential risks.

Compliance Issues in International Real Estate Investments

- Multi family offices conduct thorough due diligence to ensure compliance with local laws and regulations in different countries where real estate investments are made.

- They work closely with legal experts and advisors to navigate complex regulatory frameworks and ensure all transactions are conducted ethically and legally.

- Compliance with anti-money laundering (AML) and know your customer (KYC) regulations is a top priority for multi family offices to prevent financial crimes and maintain transparency in real estate transactions.

Risk Management Strategies for Global Real Estate Portfolios

- Multi family offices diversify real estate portfolios across different regions and asset classes to mitigate risks associated with market fluctuations and geopolitical uncertainties.

- They conduct risk assessments regularly to identify potential threats and develop strategies to minimize exposure to market volatility and unforeseen events.

- Insurance coverage, hedging strategies, and contingency plans are put in place by multi family offices to protect global real estate holdings from unexpected losses and damages.

Importance of Due Diligence and Regulatory Compliance

- Due diligence is essential for assessing the legitimacy and viability of real estate investments, ensuring that all risks are identified and managed effectively.

- Regulatory compliance helps in maintaining the reputation and credibility of investors, avoiding legal issues, and building trust with stakeholders in cross-border real estate transactions.

- By adhering to strict compliance standards and conducting thorough due diligence, multi family offices safeguard the interests of their clients and promote sustainable growth in global real estate holdings.

Reporting and Performance Analysis for Global Real Estate Holdings

Reporting and performance analysis play a crucial role in assessing the success and effectiveness of global real estate investments. Multi-family offices utilize various mechanisms to track and analyze the performance of these investments, enabling them to make informed decisions and optimize their real estate portfolios.

Performance Metrics for Evaluating Real Estate Holdings

- One key metric used is the total return on investment (ROI), which factors in both capital appreciation and income generated from the real estate assets.

- Net Operating Income (NOI) is another important metric that focuses on the income generated by the property after operating expenses.

- Vacancy rates, lease renewal rates, and tenant satisfaction scores are also monitored closely to gauge the performance and stability of real estate holdings.

Role of Benchmarking and Peer Comparison

- Benchmarking involves comparing the performance of real estate holdings against industry benchmarks or similar investment vehicles to assess relative performance.

- Peer comparison allows multi-family offices to evaluate their real estate investments against those of their peers to identify areas of strength and opportunities for improvement.

- By benchmarking and comparing performance metrics, multi-family offices can gain insights into how their global real estate holdings stack up against the market and make strategic decisions accordingly.

Closure

In conclusion, the intricate dance between multi family office services and global real estate holdings unveils a symbiotic relationship crucial for success in today's dynamic market. As investors continue to seek opportunities on a global scale, the guidance and expertise offered by multi family offices remain indispensable in safeguarding and optimizing real estate investments for generations to come.

Common Queries

How do multi family office services differ from traditional wealth management services?

Multi family office services are tailored to the specific needs of high-net-worth individuals or families, offering a more personalized approach compared to traditional wealth management services that cater to a broader client base.

Why is wealth planning crucial for global real estate investments?

Wealth planning ensures effective asset allocation, tax optimization, and generational wealth transfer strategies, all of which are vital for maximizing returns and preserving assets in the realm of global real estate holdings.

How do multi family offices mitigate risks associated with global real estate investments?

Multi family offices employ diverse risk management strategies such as due diligence, compliance measures, and portfolio diversification to minimize risks and safeguard the value of international real estate portfolios.