Exploring the realm of CPA for Real Estate Agents: Managing Cash Flow and Compliance, this piece delves into the crucial aspects of financial management and regulatory adherence in the real estate industry.

It sheds light on the role of CPAs, strategies for cash flow management, compliance requirements, and the benefits of collaborating with a CPA specialized in real estate.

Understanding CPA for Real Estate Agents

Real estate agents often rely on Certified Public Accountants (CPAs) to help them manage their cash flow effectively and ensure compliance with the necessary regulations. CPAs play a crucial role in ensuring the financial health and stability of real estate agents' businesses.

Role of a CPA in Managing Cash Flow

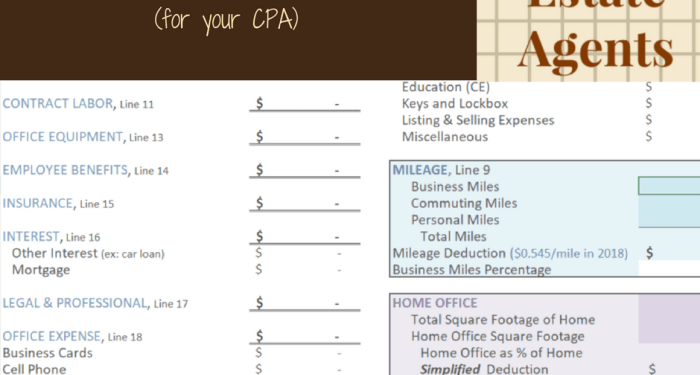

CPAs assist real estate agents in creating budgets, tracking income and expenses, analyzing financial statements, and providing valuable insights to improve financial performance. They help agents make informed decisions to optimize cash flow and maximize profitability.

Compliance Requirements for Real Estate Agents

- CPAs help real estate agents navigate complex tax laws and regulations to ensure compliance with federal, state, and local tax requirements.

- They assist in preparing accurate financial reports and disclosures as per industry standards to meet regulatory obligations.

- CPAs also provide guidance on legal and ethical considerations in real estate transactions to avoid compliance issues.

Importance of Hiring a CPA Specialized in Real Estate

It is essential for real estate agents to hire a CPA who specializes in the real estate industry due to the unique financial challenges and regulations they face. A specialized CPA brings industry-specific knowledge and expertise to help agents navigate complex financial matters effectively.

Cash Flow Management for Real Estate Agents

Effective cash flow management is crucial for real estate agents to maintain financial stability and sustain their business operations. By implementing strategies to monitor and optimize cash inflows and outflows, agents can ensure a healthy financial position and avoid potential pitfalls.

Common Cash Flow Challenges

- Irregular Income Streams: Real estate agents often face fluctuations in their income due to the unpredictable nature of the industry. This can make it challenging to plan and budget effectively.

- High Overhead Costs: Operating expenses such as marketing, office rent, and staff salaries can eat into cash reserves, especially during slow periods.

- Seasonal Trends: Real estate transactions tend to vary seasonally, impacting cash flow throughout the year.

- Delayed Payments: Commission payouts from completed transactions may be delayed, affecting cash flow timing.

How CPAs Can Help

- Financial Analysis: CPAs can provide real estate agents with in-depth financial analysis to identify areas for improvement and enhance cash flow management.

- Budgeting and Forecasting: CPAs can assist in creating budgets and forecasts to help agents plan for future expenses and revenue streams.

- Tax Planning: CPAs can help real estate agents minimize tax liabilities and optimize cash flow through strategic tax planning strategies.

- Compliance Assistance: CPAs ensure that real estate agents comply with financial regulations and reporting requirements, reducing the risk of penalties and fines.

Significance of Cash Flow Management

Proper cash flow management is essential for real estate agents to maintain financial stability, invest in growth opportunities, and weather market fluctuations. By effectively managing cash flow, agents can improve profitability, reduce financial stress, and position themselves for long-term success in the competitive real estate industry.

Compliance for Real Estate Agents

Real estate agents are required to adhere to specific compliance regulations to ensure they are operating within the legal framework. Failure to comply with these regulations can result in penalties or legal consequences.

Compliance Regulations for Real Estate Agents

- Real estate agents must comply with fair housing laws to prevent discrimination against potential buyers or renters based on race, religion, gender, or other protected characteristics.

- Agents are also required to follow disclosure requirements, providing accurate and complete information about the properties they are selling to potential buyers.

- Compliance with advertising regulations is essential, ensuring that all advertisements are truthful and not misleading to consumers.

- Real estate agents must maintain proper records and documentation of their transactions to comply with auditing and regulatory requirements.

Independent vs. Brokerage Compliance Requirements

Independent real estate agents and those working for a brokerage have different compliance requirements:

- Independent agents are responsible for ensuring compliance with all regulations on their own, while agents working for a brokerage may have additional oversight and support in meeting compliance requirements.

- Brokerages may provide training and resources to help agents understand and comply with regulations, while independent agents must stay informed and up to date on their own.

- Both independent agents and those working for a brokerage must ultimately take responsibility for their compliance with all applicable laws and regulations.

CPA Role in Ensuring Compliance

CPAs play a crucial role in helping real estate agents remain compliant with tax laws and regulations:

- CPAs provide guidance on tax deductions, credits, and other compliance issues to help real estate agents maximize their tax efficiency.

- CPAs assist in preparing and filing tax returns accurately and on time, ensuring that agents are meeting their tax obligations.

- CPAs can conduct audits and reviews to identify any compliance issues and help real estate agents address them proactively.

- By staying informed about changes in tax laws and regulations, CPAs can help real estate agents adapt their practices to remain compliant.

Benefits of Hiring a CPA for Real Estate Agents

When it comes to financial management, having a Certified Public Accountant (CPA) on board can provide real estate agents with a wide range of advantages. From ensuring compliance with tax regulations to optimizing cash flow, CPAs play a crucial role in helping real estate agents achieve financial stability and success.

Improved Tax Planning and Compliance

CPAs specialize in tax planning and compliance, which can be complex and time-consuming for real estate agents. By hiring a CPA, agents can benefit from expert advice on minimizing tax liabilities, maximizing deductions, and staying up-to-date with changing tax laws.

This not only helps agents save money but also ensures they remain compliant with all tax regulations.

Optimized Cash Flow Management

CPAs can help real estate agents develop effective cash flow management strategies to ensure a steady flow of income and minimize financial risks. By analyzing income and expenses, creating budgets, and identifying opportunities for cost savings, CPAs can help agents make informed financial decisions that support long-term growth and stability.

Strategic Financial Planning

Working with a CPA can provide real estate agents with valuable insights and guidance on strategic financial planning. Whether it's setting financial goals, creating investment strategies, or planning for retirement, CPAs can help agents make sound financial decisions that align with their long-term objectives and aspirations.

Conclusion

In conclusion, the discussion on CPA for Real Estate Agents: Managing Cash Flow and Compliance emphasizes the necessity of expert financial guidance and regulatory compliance for thriving in the competitive real estate landscape.

FAQs

What are some common challenges real estate agents face in managing cash flow?

Common challenges include irregular income, high operating expenses, and unpredictable market fluctuations. CPAs can assist in creating budgets and financial plans to mitigate these challenges.

What distinguishes compliance requirements for independent real estate agents from those working for a brokerage?

Independent agents may have to handle their own taxes and compliance reporting, whereas those working for a brokerage might have some responsibilities shared with the brokerage. CPAs help navigate these differences for agents.

How can a CPA specialized in real estate benefit agents in terms of financial stability?

A specialized CPA can offer industry-specific insights, tax planning strategies, and financial analysis tailored to the unique needs of real estate agents, leading to improved financial stability.